Saudi Arabia’s Non-Oil Private Sector Shows Sustained Growth with Modest Easing in Momentum

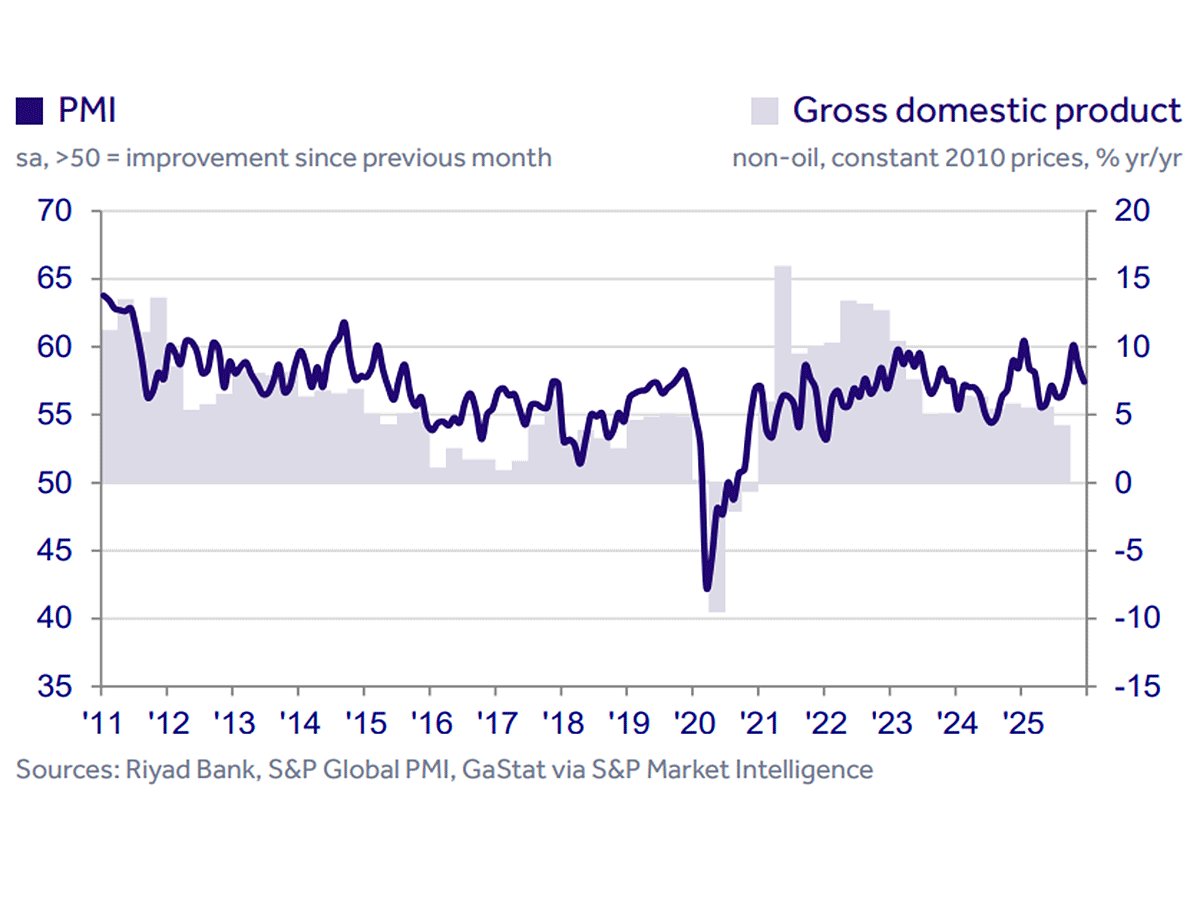

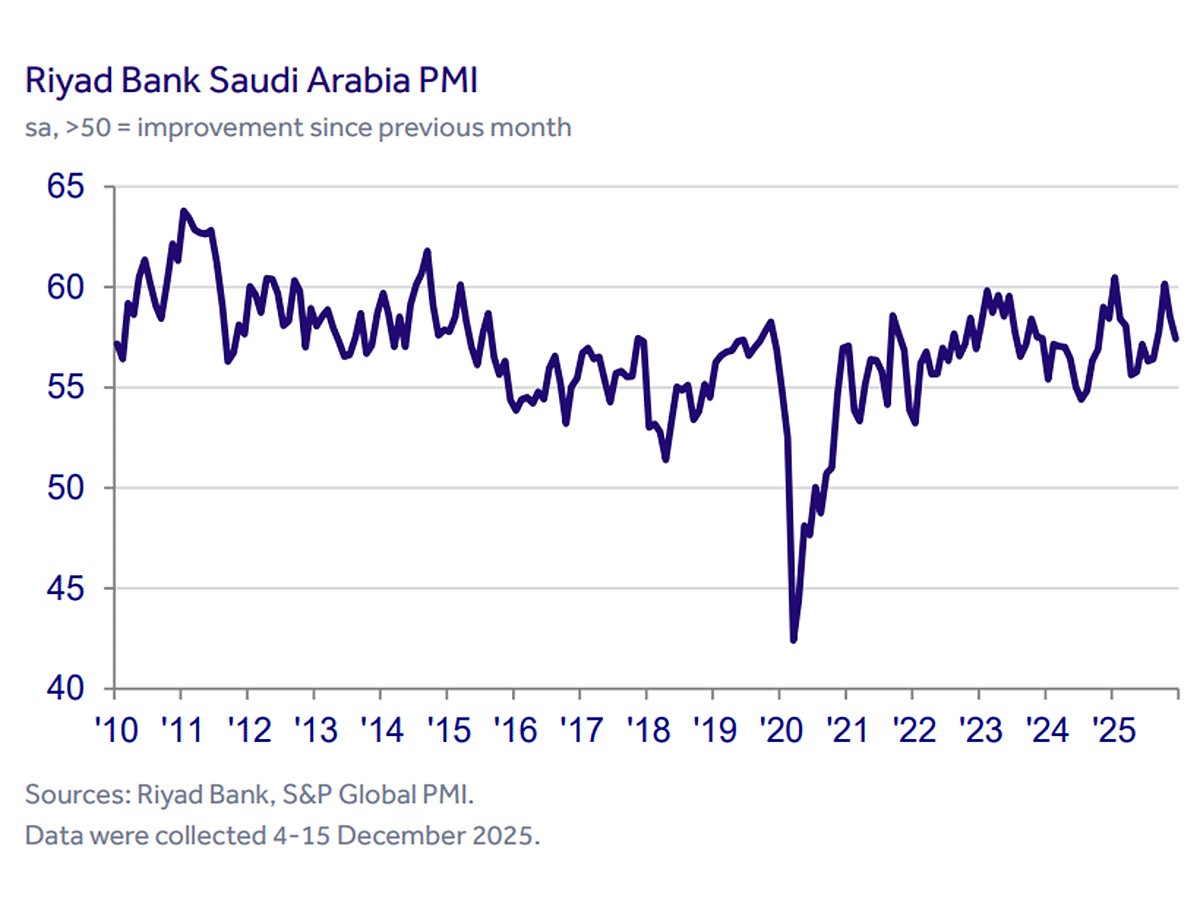

The non-oil private sector in Saudi Arabia maintained its expansionary trend throughout 2025, although the pace of growth slowed slightly in December. According to the latest Riyad Bank PMI data, the headline index dropped to 57.4 from 58.5 in November, marking the second consecutive monthly decline. Despite this, the index remained well above the 50-point threshold that separates growth from contraction and was marginally higher than its long-term average of 56.9.

This slowdown in growth is attributed to increased cost pressures and a more competitive business environment. However, the overall trajectory of the non-oil economy remains positive, with output and new orders continuing to rise, albeit at a slower rate compared to earlier months.

Strong Demand Amid Competitive Challenges

Survey participants highlighted continued strength in new orders, driven by improved economic conditions, successful client acquisition, and effective marketing strategies. Nevertheless, some firms expressed concerns about market saturation, which may have contributed to a slight cooling in order growth. This suggests that while demand remains resilient, it is not accelerating as rapidly as before.

Naif Al-Ghaith, PhD, Chief Economist at Riyad Bank, noted that “new orders stayed above the expansion threshold, signaling continued demand inflows.” He also pointed out that export demand saw a marginal increase for the fifth consecutive month, though the latest rise was the weakest in this sequence. This indicates that while external demand is still supportive, it is not uniform across all sectors.

Hiring and Backlogs Reflect Ongoing Expansion

Hiring activity remained robust in December, with non-oil firms continuing to add staff to manage workloads. Employment growth was consistent with the previous month and remained strong when compared to historical standards. Even though this growth has cooled from its peak in October, it reflects companies’ continued focus on maintaining capacity rather than scaling back operations.

Despite the increase in headcount, backlogs of unfinished work rose again, reaching their highest level since July. This suggests that demand is outpacing supply, leading to a buildup of pending tasks. Purchasing activity also increased, with firms purchasing inputs at the fastest rate in three months. This led to a rise in inventory levels, supported by improved supplier delivery times.

Intensifying Cost Pressures and Pricing Adjustments

Cost pressures intensified in December, with input costs rising at a faster pace. This was primarily due to higher prices for materials and other inputs. While wage pressures eased to their lowest level in 20 months, firms were compelled to pass these increased costs onto customers, resulting in a more pronounced rise in selling prices.

Al-Ghaith observed that “inflationary pressures increased, led by a rise in input and purchase prices, while staff cost inflation remained contained.” He added that output prices increased at a faster pace and were broadly aligned with input cost trends. This shift in pricing strategy marks a departure from earlier in the year, when some businesses absorbed cost increases to protect sales volumes in a competitive market.

Outlook Remains Positive but More Cautious

Forward-looking indicators showed a slight softening in business sentiment in December, even though firms still expect growth to continue into 2026. The Future Output Index remained above the neutral line but fell to its weakest level since July, reflecting more cautious expectations.

Al-Ghaith stated that “business sentiment softened despite remaining positive. The Future Output Index stayed above the neutral mark, indicating expectations of growth into 2026, but fell to its lowest level since July, reflecting more cautious confidence.”

Concerns about rising market competition and signs of slower order growth are influencing confidence, even as the underlying fundamentals of the non-oil economy remain strong. Domestic demand, project pipelines, and ongoing investment continue to support growth. However, as the economy normalizes and competition intensifies, factors such as pricing power, efficiency, and differentiation will become increasingly important.